Contents:

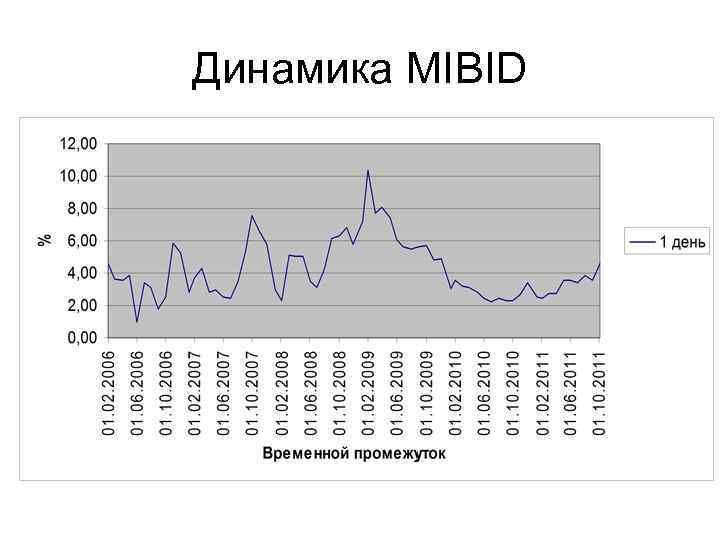

A regulator can effectively function only from a position of strength, for which the right set of skills is very essential. The government needs to offer competitive package for the brightest minds in town, the ministry believes. Please note that some of the parameters may be slightly different between the two versions of charts. Taken together, this series of papers represents a diverse and relatively large experience with the Charlson Index. In each report, CCI scores consistently correlate with disease specific survival, overall survival, or treatment-related complications, confirming its predictive validity.

CCI approves SREI Infra Finance’s acquisition by NARCL, IDRCL – PSU Watch

CCI approves SREI Infra Finance’s acquisition by NARCL, IDRCL.

Posted: Fri, 07 Apr 2023 05:49:50 GMT [source]

In the “overbought” condition, 75% price movement is essential to stay between +100. Developed in 1980 by Donald Lambert , the Commodity channel was initially designed to serve the trading community as a helpful analysis tool. Information available on this website is solely for educational purpose only. The advice, suggestion and guidance provided through the blogs are based on the research and personal views of the experts. Similarly, if the value is falling from a small positive number or 0 to a high negative number, say -100, it indicates an emerging downward trend.

You can efile income tax return on your income from salary, house property, capital gains, business & profession and income from other sources. Further you can also file TDS returns, generate Form-16, use our Tax Calculator software, claim HRA, check refund status and generate rent receipts for Income Tax Filing. Consumer sentiment indexes from the Centre for Monitoring Indian Economy and the Reserve Bank of India both showed a significant improvement. Consumer confidence increased as perceptions of employment, household income, and spending improved. Check your Preparation level with our exclusive set of Test Series and Mock Tests equipped with the latest exam pattern and syllabus.

What is a Forex Indicator?

If this happens, so it depicts an unwanted signal to the dealer that the price is highly probable to be reversed. Similarly, the next time whenever they want to see how big the trend pattern is, they will glance at CCI for a suggestion. In “oversold” condition, 75% of price movement is essential to stay between -100.

CCI can produce false signals as well, so a trader must have a clear vision of the particular signal. CCI compares both current and historical average price to conclude the outcome. High readings, such as above 100, will indicate a strong trend on the upside.

When it comes to most oscillators, divergences can also be applied to improve the strength of signals. A bullish divergence is seen where price makes a lower low but CCI forms a higher low. A bearish divergence is seen when price forms a higher high but CCI makes a lower high. A bearish divergence can also be confirmed with a break below zero in CCI or a support break on the price chart.

CCI Indicator Strategy

However, as a leading https://1investing.in/ trader also uses to find bullish and bearish divergence to identify overbought and oversold position and reversal in trends. As a leading indicator, one can look for the overbought or oversold zone which may indicate trend reversals. One can also look for bullish or bearish divergences for trend reversals. When considering which stocks to buy or sell, you should use the approach that you’re most comfortable with.

The indicator becomes overbought or oversold when it reaches a relative extreme. From oversold levels, an advance above -100 and trend line breakout could be considered bullish. From overbought levels, a decline below +100 and a trend line break could be considered bearish.

Understanding the Consumer Confidence Index (CCI)

Doing so will allow you to confirm its coefficient of variations and make more informed decisions. On the other hand, when used as a coincident, the CCI signals the emergence of uptrends (surges above +100) or downtrends (dips below -100). Determine the Mean Deviation for each period based on the formula mentioned above. As a consequence, the consumers will be saving less and spending more. Similarly, a month-on-month decrease in the CCI reflects declining consumer confidence, leading to consumers saving more and consuming less. In contrast, if the consumers are spending less and saving more, it shows they are not optimistic about their financial position or job security, thus saving for the future.

Consumption in a nation like India influences 60–70% of GDP, which is why CCI plays a significant role in the economy by providing insight into future growth prospects. Consumer Confidence Index shows how hopeful or pessimistic people are about their anticipated financial status. Spending will increase if consumers are upbeat, but if they are pessimistic, a recession could result from their poor purchase habits. The Indian finance minister suggested against using cryptocurrency.The law enforcement organization blocked the assets of two crypto exchanges.At a BJP Economic Cell event on Saturday,… This indicator will allow you to display up to 3 CCI indicators with different periods in the same pane.

The latest version of the calculator, which is provided with this manuscript, has performed without error consistently on the first , second and third authors’ Windows-based PCs. Traders use the commodity channel index to help identify price reversals, price extremes and trend strength. Just like the majority of indicators, the CCI should be used in conjunction along with other aspects of technical analysis. It works perfectly whenever the time period is one-third of the asset’s cycle. The drawback in the indicator is that cycles are often difficult to determine, e.g. in the forex market.

Forex technical analysis indicators are regularly used by traders to predict price movements in the Foreign Exchange market and thus increase the likelihood of making money in the Forex market. Forex indicators actually take into account the price and volume of a particular trading instrument for further market forecasting. The RSI tracks the momentum of price changes to analyse the overbought and oversold conditions, whereas the CCI focuses on normal deviations from an asset’s moving average price in order to spot divergences. Consumer confidence is a major factor in economic growth and is sometimes regarded as a leading indicator of household consumption spending.

Our experts suggest the best funds and you can get high returns by investing directly or through SIP. Testbook provides a set of comprehensive notes for different competitive exams. Testbook is always on the top of the list because of its best quality assured products like live tests, mocks, Content pages, GK and current affairs videos, and much more. People in Denmark and Sweden, for instance, scored minus 0.3 in June 2022, indicating that they were fairly pessimistic about the future of the economy.

To determine the overall global trend, you can use a simple moving average with a period of 200. A sign of a trend change will be the closing of the trading day below/above this moving average. CCI trading strategy is used by most traders, investors and chartists as an overbought or oversold oscillator. The basic strategy of CCI is to watch the readings above +100 and below -100. The readings above +100 are considered overbought and generate buy signals. The readings below -100 are considered oversold and generate sell signals.

- The purpose of CCI-3 is to identify quick pullbacks where an uptrending stock dips / pauses for a few days and its CCI-3 falls to -100 or lower.

- The CCI is based on a survey of consumers’ opinions and expectations, and it is typically released on a monthly basis.

- ELM constantly experiments with new education methodologies and technologies to make financial education effective, affordable and accessible to all.

- Similarly, a month-on-month decrease in the CCI reflects declining consumer confidence, leading to consumers saving more and consuming less.

- The consumer price index is the measure of consumer confidence with regards to their present and future economic expectations.

If the value is rising from a small negative number or 0 to a high positive value, say 100, it indicates an emerging upward trend. The CCI indicator has no bounds, i.e., the value can extend till + / – infinity. However, the value ranges between -200 to +200 in almost all the cases. Exceeding past the -100 level indicates a U-turn and serves as a signal to buy. CFB-Adaptive CCI w/ T3 Smoothing is a CCI indicator with adaptive period inputs and T3 smoothing. Jurik’s Composite Fractal Behavior is used to created dynamic period input.

The dip in the CCI is an indication of an oversold condition, but prices may still go down before a reversal. This problem can be resolved by buying above the high of the latest bar, and, installing a stop below the low of the dip. Often, a dip in the CCI-3 is immediately followed by a big range day. Buying above the high could mean missing such moves, and, actually ending up at the top of a short term trend. If the CCI-3 is immediately followed by a big range day, then the trader can step aside.

Is CCI a leading indicator?

The Commodity Channel Index (CCI) can be used as either a coincident or leading indicator. As a coincident indicator, surges above +100 reflect strong price action that can signal the start of an uptrend. Plunges below -100 reflect weak price action that can signal the start of a downtrend.

The term ‘channel’ in the name could be misleading, since the indicator does not actually create a channel, it plots a single line. Also, it is not exactly an ‘Index’ and it is suitable for all security types – stocks, futures, commodities, therefore it is not directly related to commodities. When there is a strong trend, CCI moves very fast from +100 to -100 zone and vice versa, and if you use it is perceived as a reversal signal, there are chances of losing the profit from the original position.

Which indicator works best with CCI?

It is extremely important, as with many trading tools, to use the CCI with other indicators. Pivot points work well with the CCI because both methods attempt to find turning points. Some traders also add moving averages into the mix.

While you may not get every trade right, consistency is vital, and the CCI indicator will give you an edge in the long run, particularly when combined with other indicators. The 0.015 constant is simply a statistical adjustment to make most of your CCI values fall between -100 and 100. The Consumer Confidence Index measures the degree of optimism of a group of buyers in the economy. A dual commodity channel index plots two variations of CCI lines, which gives traders an even more granular understanding of the momentum of a financial asset. The commodity channel index is computed by taking the difference between the current price of a financial asset and its moving average, and later to be divided by the mean absolute deviation of the price.

What does CCI indicator tell you?

The Commodity Channel Index (CCI) measures the current price level relative to an average price level over a given period of time. CCI is relatively high when prices are far above their average.

For instance, if the trend has good momentum, the possibilities are high that rates will begin to increase or fall. As a leading indicator, the analysts should search for over-sold or overbought situations because it’s likely to trigger a mean reversion. CCI is an Unbounded Indicator because, unlike others, it can indefinitely glide higher or lowers down.

Which is better RSI or CCI?

This occurs whenever new price peaks and valleys are not mirrored by corresponding momentum peaks and valleys. Such divergences highlight possible trend reversals. Generally speaking, the RSI is considered a more reliable tool than the CCI for most markets, and many traders prefer its relative simplicity.