Contents:

This function allows you to keep payroll costs in one place rather than having to pull in information from a separate system. You should reconcile weekly, if not daily, to ensure that your accounts are as accurate as possible. The amount of money that can potentially hold in a tax-free retirement account, will increase by $200,000 on 1 July 2023. With PocketSmith you can store, categorize, filter and search your transaction history as well as make budgets to track and understand your spending. We are a slightly geekier variant of Xero Personal, and have all the features that Xero Personal offered, but with so much more. Create cash projections with ease using our calendar view.

Additionally, you can save reports in either format to your computer as well to share or use at a future date. NerdWallet’s ratings are determined by our editorial team. The scoring formulas take into account multiple data points for each financial product and service.

Set up your chart of accounts

Like Xero Personal, save time and connect your personal accounts from over 12,000 financial institutions in 49 countries to easily see where your money is going. Once you’ve mastered the basics of using Xero for your personal finances, there are a few tips and tricks you can use to get the most out of the system. Once you’ve set up Xero for your personal finances, you can start to manage them through the system. Run things smoothly, keep records tidy, and make compliance a breeze with cloud based accounting.

Setting up payment reminders and organising your credit control systems can help you to get paid faster. Keep your practice a step ahead with Xero accounting software. Businesses that do not want to work with a professional accountant or bookkeeper.

https://bookkeeping-reviews.com/ skillfully automates and simplifies every element of small business accounting. Built for the web from the ground up, its double-entry accounting framework supports sales, purchases, bills and expenses, inventory, and payroll. You can create records for customers, suppliers, employees, and items and then use those records in standard customizable transactions, such as invoices, purchase orders, and quotes. Xero also lets you manage fixed assets—something competitors typically don’t do.

Watch the ‘Xero Dashboard’ video

If you prefer to bill for the whole project once it’s been completed you can do so, but you can also send invoices at any time for specified time and/or expenses. You can track projects in Xero Established, thanks to tools that have been finalized over the last couple of years. They’re quite effective and well-suited to small businesses that don’t need a full-blown project management app. Which accounting app has the best, most effective user experience, then?

You can set up invoice reminders, configuring Xero to automatically send customers reminders based on how far an invoice is past due. Have you ever wondered how a transaction would affect your books, but you didn’t want to risk messing up your financials? Xero’s demo company lets you experiment with usable test data.

And Xero does regular data security audits and monitors security systems to identify and manage threats. NerdWallet strives to keep its information accurate and up to date. This information may be different than what you see when you visit a financial institution, service provider or specific product’s site. All financial products, shopping products and services are presented without warranty. When evaluating offers, please review the financial institution’s Terms and Conditions.

Xero now does something that I haven’t seen in another accounting application. When you click the question mark in the upper right corner, the help files that open are context sensitive. Some screens, of course, don’t really need further explanation, but I found that this worked on every screen where it seemed to be needed.

Accounting software for your small business

In contrast, QuickBooks Online Plus’s customer and vendor records are more comprehensive. They let you store more preferences, like preferred payment and delivery methods, language to use in forms, and so on. Its record templates also display data more economically, using tabs to access hidden details.

Transport union ‘confident’ Scott’s Refrigerated Logistics workers will be redeployed, banks pass on RBA rate rise, ASX closes flat — as it happened – ABC News

Transport union ‘confident’ Scott’s Refrigerated Logistics workers will be redeployed, banks pass on RBA rate rise, ASX closes flat — as it happened.

Posted: Wed, 08 Mar 2023 08:00:00 GMT [source]

Say goodbye to complex spreadsheets and plot your financial future in an intuitive calendar format, and visualize it all in a balance forecast graph. Load up all your accounts with PocketSmith, and get up-to-date currency conversion information for your international account balances. †Invoice limits for the Early plan apply to both approving and sending invoices. Hubdoc is included in Xero Early, Growing and Established plans as long as it’s connected to your Xero subscription.

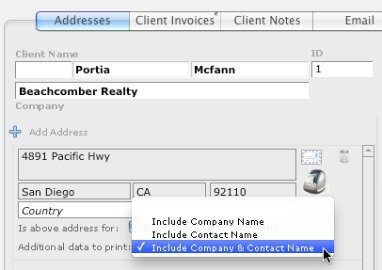

I have a few clients who have loved Xero so much that they have decided to us it to manage their personal finances as a personal finance app. Yes, more than 1,000 third-party apps integrate with Xero accounting software. It is not necessary to have an accountant or bookkeeper to use Xero, but the company does encourage small business owners to use a professional along with the software. After you supply Xero with your contacts’ information, they will always be available to you for sending and receiving invoices and managing payments.

Chasing payment from customers that have already paid can tarnish your reputation. You can come back to this step once daily reconciliation is part of your routine. You also need to link to any active payment services to your Xero account.

However, if money flows between the two businesses, you need to make sure the transactions are properly recorded in each business’s accounting. Viewing both virtual bookkeeping files at once can make sure this happens correctly, but logging in to multiple Xero organizations at the same time might be problematic. If you’re trying to juggle multiple different logins, you might forget to save your work or save it in the wrong organization. We live in a digital age where most of us use credit / debit cards or pay by EFT when shopping.

Buttons at the top of the page take you to your passion shop reviewss where you can create new invoices or credit notes, send statements, and import or export invoices in CSV format. Xero uses AI and other automated tools to simplify, organize, and accelerate accounting tasks. Recent improvements to invoices, reports, and online support make it an excellent choice for small businesses. You can sync your Xero account to your Gmail and thereby export Xero reports or budgets to Google Sheets. To implement this, all you have to do is go to a report or budget that you’d like to export. You’ll be prompted to choose your export method — choose Google Sheets.

Set up your organisation details

Xero introduced a new expense-tracking system a couple of years ago. The Expense Claim tool provides a better user experience, enhanced functionality, and more flexible user permissions. Or you can snap a picture in the Xero Expenses mobile app and create an expense, which will then appear in the desktop version with a picture of the receipt . Click on Awaiting Payment under Invoices, and a new window opens displaying a table of matching transactions. While you’re there, you can toggle among tabs representing their different statuses.

- Click a link in the upper right corner to access tasks like editing, emailing, and repeating the invoice.

- Rick VanderKnyff leads the team responsible for expanding NerdWallet content to additional topics within personal finance.

- Competing accounting apps do not offer a comparable feature, except for Zoho Books Premium.

- You should reconcile weekly, if not daily, to ensure that your accounts are as accurate as possible.

There will be additional enhancements made over the next several months in areas like accessing and searching for data, and customization. Xero’s project tracking tools are good, though they lack some of QuickBooks Online’s functionality, like the ability to add purchase orders and assign bills to projects. The Xero project tools are also not as easy to understand as QuickBooks Online’s. Once you’ve exported your document into Google Sheets, you can edit, save or share it.

Here’s how to do everything from rewinding a reconciliation mistake to setting up invoice reminders. Finally, if you work with one, ask your accountant to check your set up. They may need to add year-end conversion balances and can ensure that your year-to-date figures are as expected. Initially, when you’ve input some data, look at your Balance Sheet, Profit And Loss, Aged Receivables, and Aged Payables.

It makes better use of screen space than its closest competitors and minimizes confusion with its intuitive design. The Xero family of applications is more affordable than Editors’ Choice Intuit QuickBooks Online, which costs between $30 and $200 per month. The version of QuickBooks that’s most similar to Xero Established costs $85 per month. One of the lowest-priced accounting services for small businesses is Patriot Software Accounting Premium ($30 per month). Zoho Books, another Editors’ Choice winner, now has six pricing levels that go from free to $240 per organization per month; it’s $60 per month for a version similar to Xero Established. If you have regular invoices to send or bills to pay, save yourself the trouble of having to repeat the same process again and again with this Xero trick.

BILL Partners with BMO to Help Businesses Digitize and Streamline … – Yahoo Finance

BILL Partners with BMO to Help Businesses Digitize and Streamline ….

Posted: Thu, 09 Mar 2023 08:00:00 GMT [source]

That is why Xero recommends PocketSmith as the best alternative to Xero Personal to be your personal budget manager. If you want to get clear on your personal finances using Xero as a personal finance app is an option. It was of course designed for SMB’s but if you are already comfortable with it for your business, why not give it a try for your personal finances too. You’ll receive your invoice at the end of your monthly billing period. Payment will be taken on the date shown on your invoice using the payment details entered when you purchased your subscription. If you’ve incurred usage charges for Xero Payroll, Xero Projects or Xero Expenses – or you have a chargeable direct bank feed – these charges will be invoiced for the previous month.